Sustainability

The strategic goal of our sustainability management activities is to further anchor sustainability in our core business. These efforts are directed by a sustainability manager and a sustainability committee comprised of employees from various departments within the Bank.

During the year under review we developed an additional sustainable financing product in our residential property financing area of business: the MünchenerHyp Family Loan. This product addresses an important social dimension of a holistic understanding of sustainability. The social benefits of the MünchenerHyp Family Loan consist of providing support to lower and middle income families by making an interest rate rebate available to them. The sustainability of the Family Loan has been certified by Oekom Research, which confirmed that the loan “makes a contribution to the intergenerational creation and securing of prosperity, taking into account such aspects as equal opportunity, participation and quality of life, as well as developments that arise in the course of demographic change”. The Family Loan was introduced to the market at the beginning of 2018.

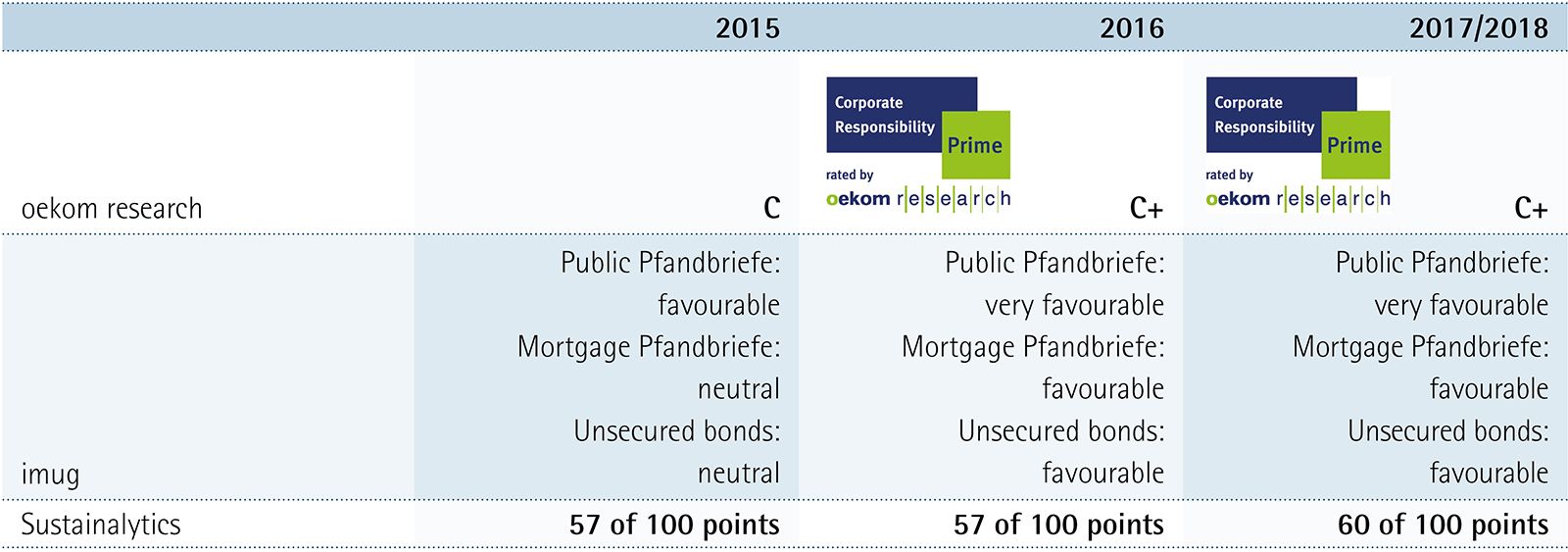

The sustainability rating agency oekom research continues to rate MünchenerHyp as one of the three best banks in the category of “Financials/Mortgage and Public Sector Finance”. We received a C+ rating. Oekom Research rates MünchenerHyp ecological commitment with B-, and its social commitment with C+. At the same time the agency also confirmed the Bank’s “Prime Status”.

The agency imug confirmed all of MünchenerHyp’s sustainability ratings at the beginning of 2017. The agency issued a “very favourable” rating for our Public Pfandbriefe, and a “favourable” rating for our Mortgage Pfandbriefe and unsecured bonds. The rating for Mortgage Pfandbriefe means that the Bank holds the best rating among the 30 German issuers rated by imug.

The sustainability rating agency Sustainalytics raised our rating in the beginning of 2018. We currently are rated 60 out of a possible 100 points.

The development of our sustainability ratings since 2015 at a glance: