rating

In November 2017 the rating agency Moody’s raised its Baseline Credit Assessment (BCA) for MünchenerHyp to ba1. The BCA corresponds to the standalone rating of a bank. This decision takes various favourable developments of MünchenerHyp’s key figures into consideration. The higher BCA rating was primarily due to the further improvement in the Bank’s level of equity capital, as well as the moderate risks in its loan portfolio.

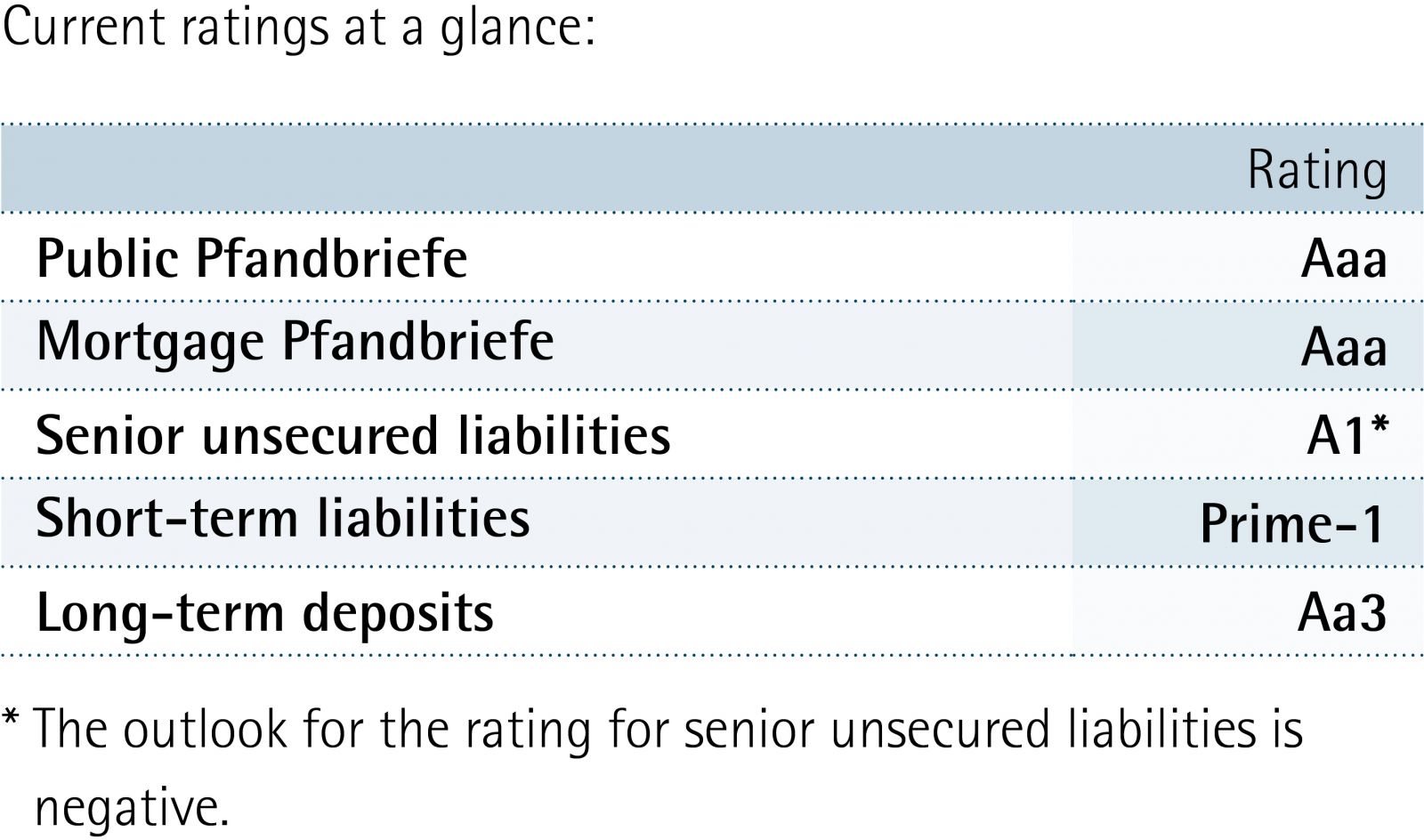

Moody’s final rating for the Bank – including external support from the government and the Cooperative Financial Network – did not change. In December 2017 the agency did, however, change the outlook for the rating of the Bank’s senior unsecured liabilities to negative.

The revision is due to a change in the methodology Moody’s employs to make its ratings. The rating agency now assumes that the EU’s Bank Recovery and Resolution Directive (BRRD) will be transformed into national law in Germany leading to the federal government providing weaker support to many banks. For this reason, the negative outlook affects a total of 16 banks that Moody’s rates in Germany. The outlook for all other of MünchenerHyp’s ratings remained stable.

Moody’s did not change its opinion that MünchenerHyp had a solid reputation in the capital markets as an issuer of Pfandbriefe and thus has a correspondingly high level of refinancing strength. The agency also noted favourably the Bank’s firm ties and related support within the Cooperative Financial Network.

Even to achieve its highest rating of Aaa for Pfandbriefe, Moody’s only requires that legal requirements are observed, thus voluntary provision of surplus cover is not required.

Our long-term unsecured liabilities are rated AA- by both of the two other major rating agencies Standard & Poor’s and Fitch due to the group rating assigned to the Cooperative Financial Network by the agencies.