New Mortgage Business

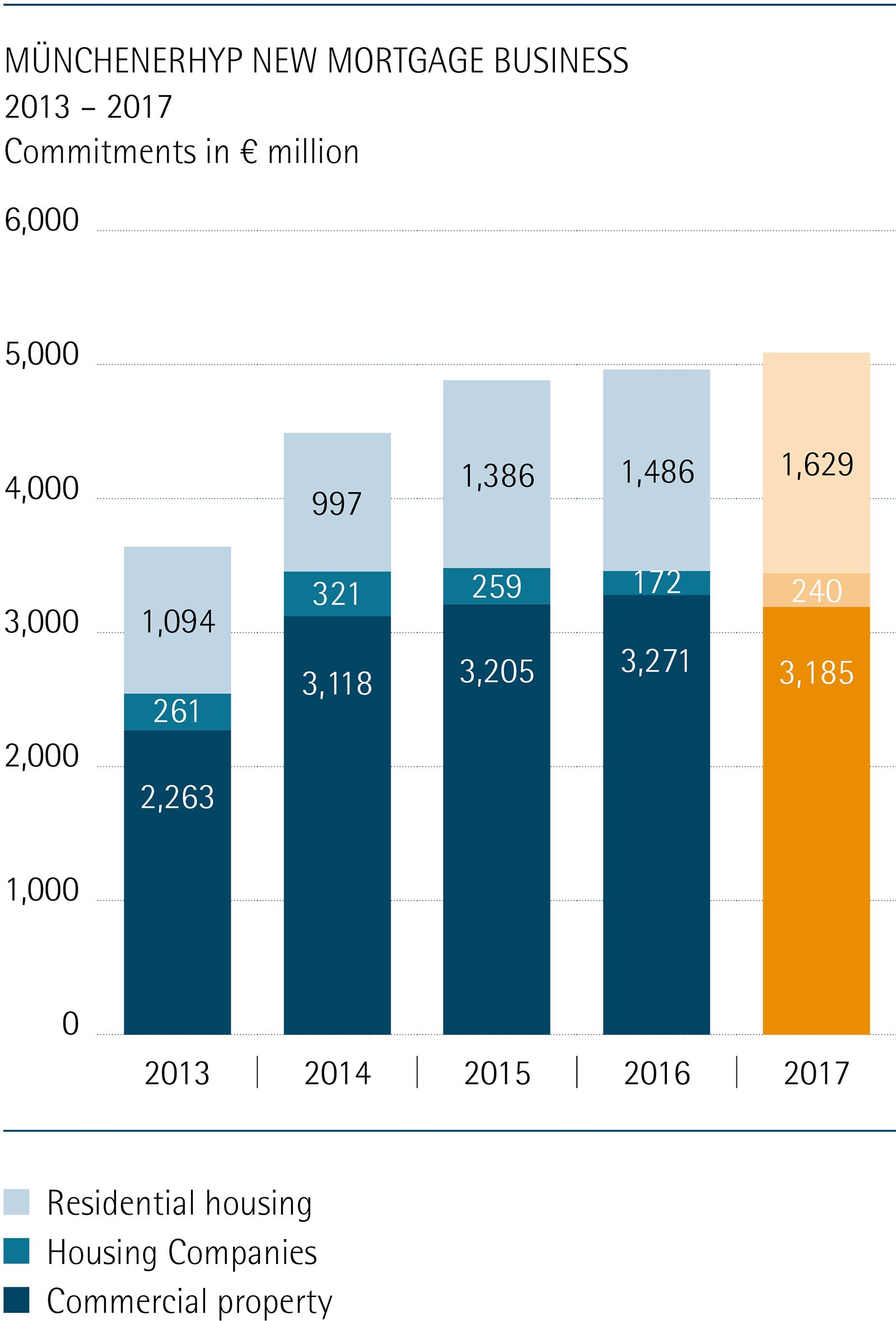

MünchenerHyp set a new record in 2017 as our volume of new mortgage business exceeded € 5 billion for the first time. Our new business grew by 2.5 percent as we made € 5.1 billion in lending commitments (previous year € 4.9 billion), thereby reflecting a slightly faster pace of growth in our business.

Both of our main areas of business, private and commercial property financing, benefited from the good environment for property and the associated high demand for property financing seen during the year under review. For this reason, we are very satisfied with the development of our new business activities, which were able to expand as forecast

We were able to sustain our new business performance in the private property financing area at the previous year’s very high level in the intensely competitive market. We made loan commitments for a total volume of € 3.2 billion (previous year: € 3.3 billion). Our special sales campaigns in the spring and autumn of 2017 contributed to this success as each of them was met very favourably by our partner banks and customers. In addition, the share of forward financing transactions developed favourably in view of considerations that the ECB’s loose monetary policy could be ending.

The volume of new lending commitments made to finance domestic private residential property brokered by banks within the Cooperative Financial Network was € 2.4 billion, basically unchanged from last year’s volume of € 2.45 billion. Sales generated by independent providers of financial services increased by 8 percent on a year-over-year basis to € 419 million. New business brokered by Swiss PostFinance totalled € 373 million, or about € 50 million below the previous year’s level due to intensifying price competition.

Our commercial property financing business was successful in 2017 and grew by 13 percent to € 1.9 billion (previous year € 1.7 billion).

We are particularly pleased that we were able to achieve these good results in a competitive environment characterised by shrinking margins and competitors willing to take on riskier financing deals. For our part we succeeded in attaining comparatively attractive margins across the entire span of our new commercial property business without exposing the Bank to inappropriate risks.

We posted gains in our domestic, as well as our international business activities, especially in Great Britain, Spain and the Netherlands, which contributed to our good results. In addition, our re-entry into USA also made a favourable impression.

Furthermore, our new commercial property finance business benefited from the Bank’s new syndication strategy where we act as the underwriter for larger loans that are generally more margin-attractive. We then syndicate a volume of about € 200 million to other providers of financing, with a special focus on our Cooperative Financial Network’s syndication programme. Within the framework of the programme we enable the Volksbanken and Raiffeisenbanken to participate in commercial property loans we have made. This offer received a very favourable response.