Property and Property Financing Markets

Residential Property – Germany

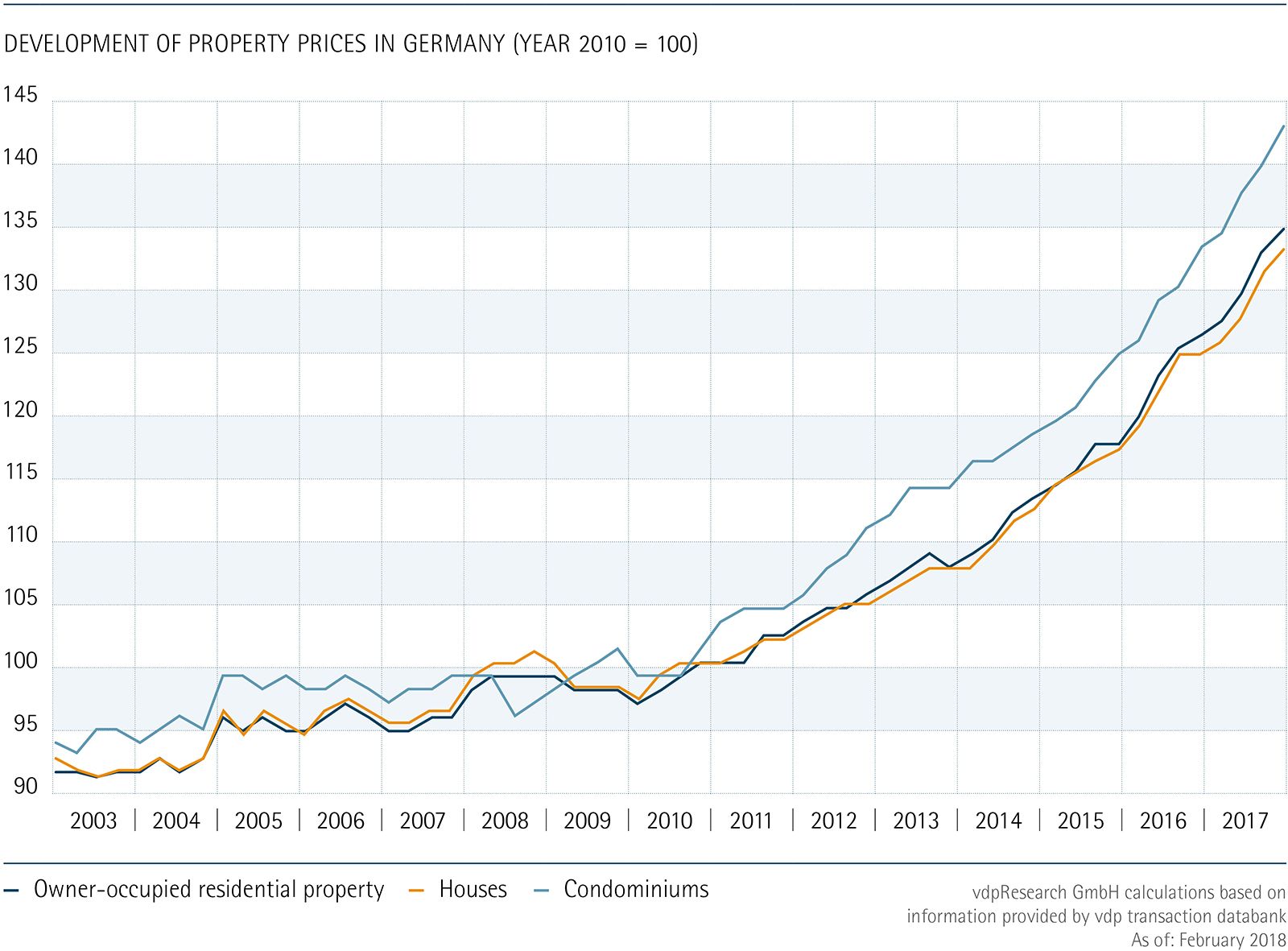

The residential property market in Germany was again marked by rising purchase prices and rents in 2017. Prices accelerated even further compared to the previous year rising by 6.9 percent in 2017 according to the Association of German Pfandbrief Banks’ (vdp) index for residential property prices. The strong 5.8 percent rise in prices affected owner-occupied residential property, as well as multi-family houses, which posted an increase of 7.9 percent.

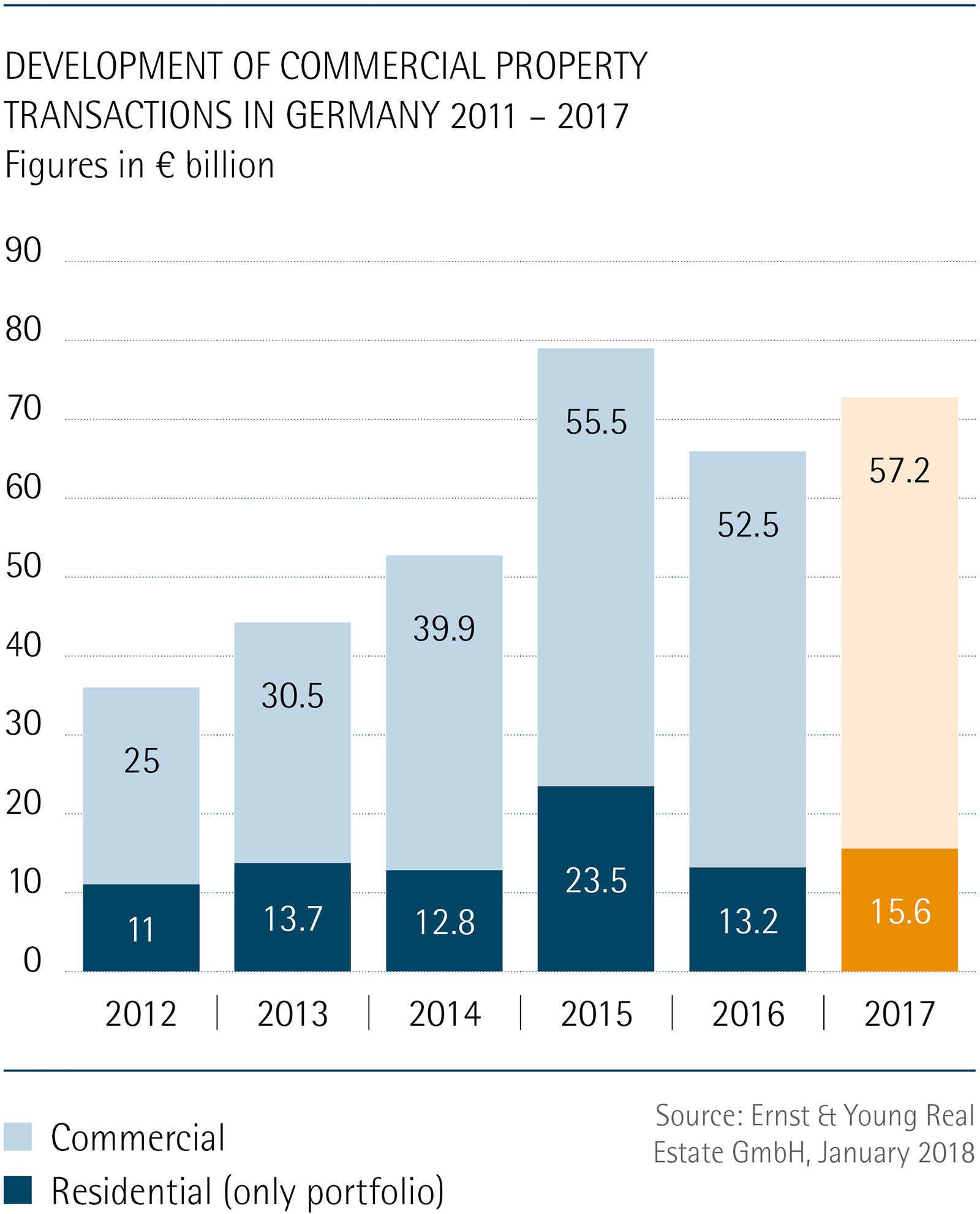

The pronounced increase in prices paid for multi-family houses was driven by high demand shown by institutional investors, which in turn led to a further decline in yields. A total of € 15.6 billion was invested in residential property portfolios in 2017, the third highest amount recorded within the last ten years. This segment of the market remained dominated by domestic investors with foreign buyers only representing 20 percent of the capital invested. Buying activity was focused on the seven biggest cities and major cities with above-average population growth as investors viewed these cities as offering the greatest market liquidity and thus the least risk. The availability of existing properties was tight across Germany. This led to a shift in investors’ buying activities over to projects that were in the developmental stage. As a result, new construction developments represented about 30 percent of the total volume of transactions.

The great interest shown in residential property in Germany – despite low yields – is due, in particular, to the situation in the rental housing market where shortages have existed for years in major metropolitan areas. The excess demand is due to the high number of persons moving to these regions, the current favourable income opportunities, as well as the significant increase in single-person households. This has led to rising rents, in particular, without higher yields as purchase prices have increased at a faster pace than rents. Based on vdp figures, the tempo of rental increases has slowed slightly to 3.2 percent, although it does continue to show that the situation in the rental housing market remains tight.

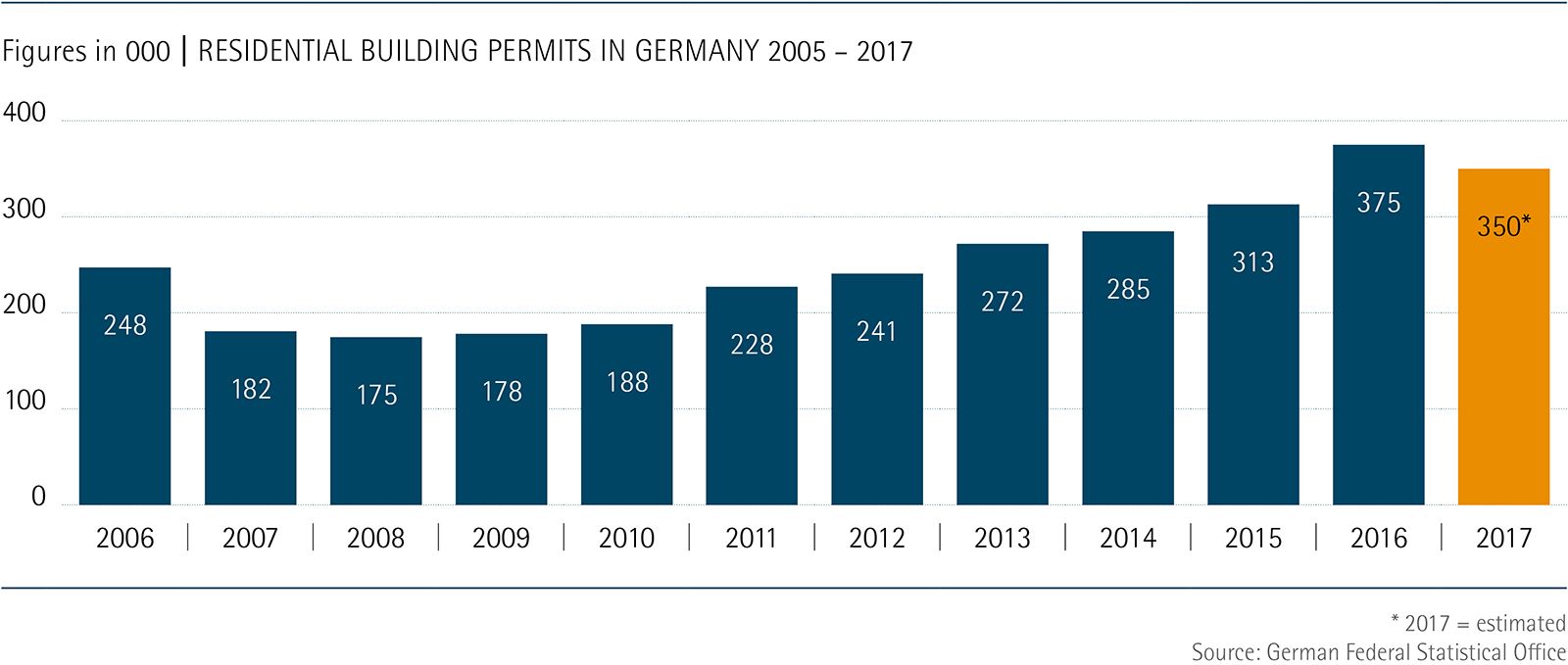

Although construction of new multi-family housing accelerated, the figures for newly completed housing still lags noticeably behind the number of newly issued building permits. In addition to the fact that the construction sector is operating at a high level of its capacities, it is thought that many building permits are being obtained without a specific intention to build. The total number of building permits issued by the end of November 2017 declined by 7.8 percent compared to the same year-ago period. This decline affected all segments.

Despite the very strong gains recorded for housing prices in many regions, high demand seen for houses and condominiums has also remained unchanged. Many private households would like to realise their hopes to buy their own home in view of low interest rates, the good employment situation and the favourable development of incomes. However, the number of transactions involving one and two-family houses barely changed in 2017. On average, about 250,000 private homes change hands every year indicating that there is a limited supply. Homeowners’ willingness to sell was held back by a lack of investment alternatives and expectations that property prices will continue to climb.

New construction activity noted during the year under review was once again unable to keep pace with the high demand. Although the number of newly built homes has continually increased across the nation since 2010, and set a new 15-year record in 2017 with about 280,000 new housing units, it still lags behind actual housing needs. After taking into consideration various factors – above all migration to and within Germany, smaller households, and the backlog of demand for housing – Germany needs 350,000 to 400,000 new housing units per year.

Higher demand is primarily driven by fast growing regions and cities, which in turn have posted above-average strong price increases in recent years. According to figures released by vdp, residential property prices in the seven largest German cities rose by 13.7 percent in comparison to the previous year.

This was sufficient reason for the Bundesbank to closely examine development in cities and regions with very strong price growth in its latest Financial Stability Review. The study concluded that exaggerated prices exist in 127 German cities. However, the Bundesbank believes that threats to price stability still remain limited. This statement is based, in particular, on the slower pace of growth of loans for new housing, which is lower than the long term average rate. Furthermore, debt carried by private households showed a further slight decline and in 2017 and was substantially below the average figure in comparable economies. Another important aspect in the assessment was the unbroken trend of borrowers to obtain longer terms of fixed interest rate loans for financing housing, which also reduces their risk of fluctuating interest rates.

Competition among providers of private property financing increased even further. Enterprises within the Cooperative Financial Network, which include MünchenerHyp and its partner banks, held up well in this environment. As in previous years, the portfolios of residential property loans held by institutes within the Cooperative Financial Network expanded at a faster rate than the market.

Residential Property – International

In general, the residential property markets in Europe developed favourably, whereby the average increase in prices for all countries within the European Union (EU), as well as those within the euro area, strengthened again in 2017. The rise was driven by the favourable economic situation and the continuing low level of interest rates. Prices paid for houses in the EU in the third quarter of 2017 rose by 4.6 percent over the same year-ago period and by 4.1 percent in the euro area. Markets where a stronger pace of growth was noted include the Czech Republic, Ireland, Portugal, Hungary and the Netherlands, where double-digit percentage gains were recorded. Italy was the sole market where housing prices once again declined slightly.

The pace of rising prices for residential property in Great Britain weakened since mid-2016 as a consequence of the Brexit vote. However, in 2017 housing prices still increased by 5.2 percent over the previous year’s figure, although there were notable regional differences. Prices in South West England grew by 7.5 while prices in London only increased by 2.5 percent. Furthermore, the volume of transactions fell by 6 percent in the same period of time. New construction of housing amounted to about 180,000 new housing units, which was substantially below the government’s target of 275,000 housing units per year. The pace of growth noted in the private rental housing also slowed and the 1.1 percent increase noted was the lowest recorded since January 2012. London’s increase of only 0.2 percent made it one of the weakest growing regions in the UK.

New construction of housing in France expanded notably in the past year as the number of housing units being built rose by about 15 percent to nearly 400,000 units or the highest level since 2011. At the same time, demand for housing was quite favourable in light of low lending rates. This development was also reflected in the number of new housing transactions, which climbed by 8 percent, and turnover of existing properties, which advanced by 9 percent. Prices paid for housing also rose. In the third quarter of 2017 prices of newly built properties rose by 3.6 percent over the same year-ago quarter, while existing properties were 3.9 percent more expensive. French residential property also gained in attraction by institutional investors, which in turn increased pressure on yields notably and especially for prime properties.

The Dutch housing market was driven by above-average economic growth, which was reflected by the very substantially higher figures recorded for the number and volume of transactions. A total of about 242,000 housing units changed hands in 2017, or about 13 percent more than in the previous year. The volume of transactions surged by 22 percent to nearly € 64 billion. Parallel to this development, prices paid for housing rose even further by 7.9 percent in comparison to the previous year’s figure. This increase was driven by high demand that met a very limited supply. Excess demand was particularly visible in the four major population centres of Amsterdam, Utrecht, Den Haag and Rotterdam. Institutional investors also focused their demand on these four cities last year as they invested € 3.5 billion in residential property. Domestic buyers accounted for about two-thirds of the volume of transactions. The Dutch housing market as a whole was marked by a very tight supply of properties for institutional investors, which led to a further decline in returns.

Despite overall favourable economic conditions, growth noted for the Swiss housing market slowed over the course of the year. This is reflected by figures released by the Swiss Federal Statistical Office which showed that the number of vacant housing units stood at about 65,000 at mid-year 2017. This figure is nearly 15 percent higher compared to the previous year’s figure, whereby the rental housing market was particularly affected. During the course of the year rents declined slightly, especially for units in the higher-priced segment. The level of prices paid for housing hardly changed on a year-over-year basis. Prices for condominiums rose by 1.9 percent and were only marginally higher than in 2016; prices for single-family homes grew at an unchanged 3.2 percent. Demand for residential property for personal use and as an investment remained high due to the Swiss National Bank’s negative interest rates, as well as low mortgage rates.

The upswing in the housing market in the USA continued in 2017. In November of 2017 the S&P/Case-Shiller Index figures showed a 6.2 percent year-over-year increase in housing prices. Prices did, however, vary quite differently on a regional basis with the strongest growth again recorded in the Seattle region, while Chicago and Washington D.C. remained at the bottom of the list. The increase in prices is due to excess demand and insufficient construction of new housing. Rents developed less dynamically rising by 2.4 percent following the 3.8 percent increase recorded in the previous year. Investments in residential property also fell. During the first nine months of 2017 USD 94 billion, or 12 percent less, was invested than in the same year-ago period. This change indicates that for the first time since 2009 the volume of transactions may also be lower for the entire year.

Commercial Property – Germany

German commercial property was again highly sought after by both national and international investors. This was, above all, due to the quality of Germany as an investment location, and not yields, as meanwhile returns on all asset categories are at historically low levels following above-average increases in prices seen in recent years. This was also the case in 2017 as the vdp index for commercial property rose by 6.5 percent on a year-over-year basis. This was the greatest increase in prices since the outbreak of the crisis in the financial markets.

The strong pace of growth noted for prices also led to a record volume of transactions in 2017. The figure if more than € 57 billion exceeded the top results recorded in 2015 by about 3 percent. Investors continued to focus on the seven biggest cities. Where € 31 billion were invested, or 54 percent of the total volume of transactions.

Office properties retained their preferred status as investments. This sector has held about a 44 percent share of the total volume of transactions for years and represents turnover of just about € 25 billion. The great popularity of office properties is based on the very good state of the rental market, which again set a new record in the past year with total turnover of about 4.2 million square metres of space in the seven biggest cities. The volume of newly completed properties was, however, lower compared to the previous year’s figure. This led to a further decrease in available vacant space. At the end of 2017 the vacancy rate stood at the lowest level seen in the last 15 years. In the interim there is hardly any office space available in preferred office districts in the seven biggest cities, which in turn has driven rents for office space even higher. The greatest increase in rents was noted in Berlin. Moreover, rising rents and great investor interest accelerated the pace of rising prices for office properties. Based on vdp figures, prices for office properties rose by 8.4 percent in comparison to the previous year.

The popularity of logistics properties increased in the past year while interest in retail properties decreased slightly. Many investors are increasingly viewing retail properties more critically in view of the booming online shopping business and the very high level of prices demanded for retail properties, which has shifted investors’ attention to other asset categories.

Commercial Property – International

The good overall economic conditions had a particularly beneficial effect on the European office property market. Turnover of space in the rental market increased by 10 percent to 13 million square metres, which was the best result noted since 2007. This rise was accompanied by a substantial reduction of vacant space, which declined across Europe to 7.4 percent. On average, rents in Europe rose by 4 percent due to the limited availability of space.

Following the sudden downturn after the Brexit decision, the commercial property market in Great Britain has regained its footing and is advancing notably once again. This is reflected by the 15 percent increase in the volume of investments made in 2017. Foreign investors dominated market activities and accounted for about three-quarters of the volume of transactions recorded for office properties in London. Furthermore, turnover of space increased by 7 percent shrinking the vacancy rate to 4.7 percent and below the 10-year annual average. The short-lived drop in rents that occurred the previous year was stopped in 2017 due to the good demand seen for office space. This made it possible for peak rents to end the year on a stable note.

The volume of transactions noted for the French investment market declined once again. During the first nine months of 2017 more than € 14 billion was invested in commercial properties, or about 30 percent less than in the same year-ago period. The drop was due to a lack of investment properties as investors were still very keen on buying. Yields fell further in view of this situation. Properties in the Île-de-France were the preferred choice of investors with a significant focus on office properties. The vacancy rate moved at the previous year’s 6.7 percent level. Top rents paid for office space remained stable while average rents paid, however, rose to a level last seen in the year 2000.

The Dutch investment market ended the last year with record results as total turnover for properties amounted to € 19.5 billion. Foreign companies accounted for a major portion of the capital invested. The primary focus was on office properties followed at great distant second place by retail and industrial properties. The upturn in office properties continued in 2017 and led to a substantial increase in rents. Amsterdam posted the highest rate of growth in Europe. The vacancy rate for office space fell reflecting the extremely favourable development of the economy.

The volume of transactions recorded for the American investment market declined again as foreign investors were less active. At mid-year point in 2017 volume was 14 percent below the same year-ago level. As the most important investment location in the USA, New York was particularly affected by this development as the volume of transactions recorded fell by half. In contrast, investors significantly expanded their activities in Boston, Washington D.C. and Los Angeles. The rental market is already in an advanced phase of its cycle, as reflected in the notable weakening in the growth of rents. Office properties were also the most important asset class in the USA and demand for office space was robust. The average rent paid for office space rose by 2.7 percent on a year-over-year basis. Nevertheless, the vacancy rate for office space rose slightly due to brisk new construction activities accompanied by a lower rate of pre-completion leases signed.