Financial Markets

Financial markets were supported by the unexpectedly favourable economic developments, as well as the central banks’ unchanged generous provision of liquidity, and a better mood among market participants than in previous years.

During the course of the year the European Central Bank (ECB) nevertheless retained its expansive monetary policy and left its deposit facility rate for banks unchanged at minus 0.40 percent, while its interest rate on the main refinancing operations (MRO) held steady at 0 percent. Within the framework of its asset purchase programme the net amount of monthly purchases over the course of the year amounted to 60 billion euros per month. Additional important central banks, like the Bank of Japan, the Bank of England and the Swiss National Bank, also provided expansive liquidity in support of the economic recovery process. The policy followed by the American central bank, the Federal Reserve (Fed), diverged from the other central banks as the Fed further tightened its monetary policy during the year under review and raised its key interest three times by 25 basis points each time in light of the favourable development of the American economy. At the end of 2017 the Fed’s decisions led to a federal funds rate corridor of 1.25 percent to 1.5 percent. Concurrently, the Fed began to reduce its balance sheet that had expanded due to its bond purchases.

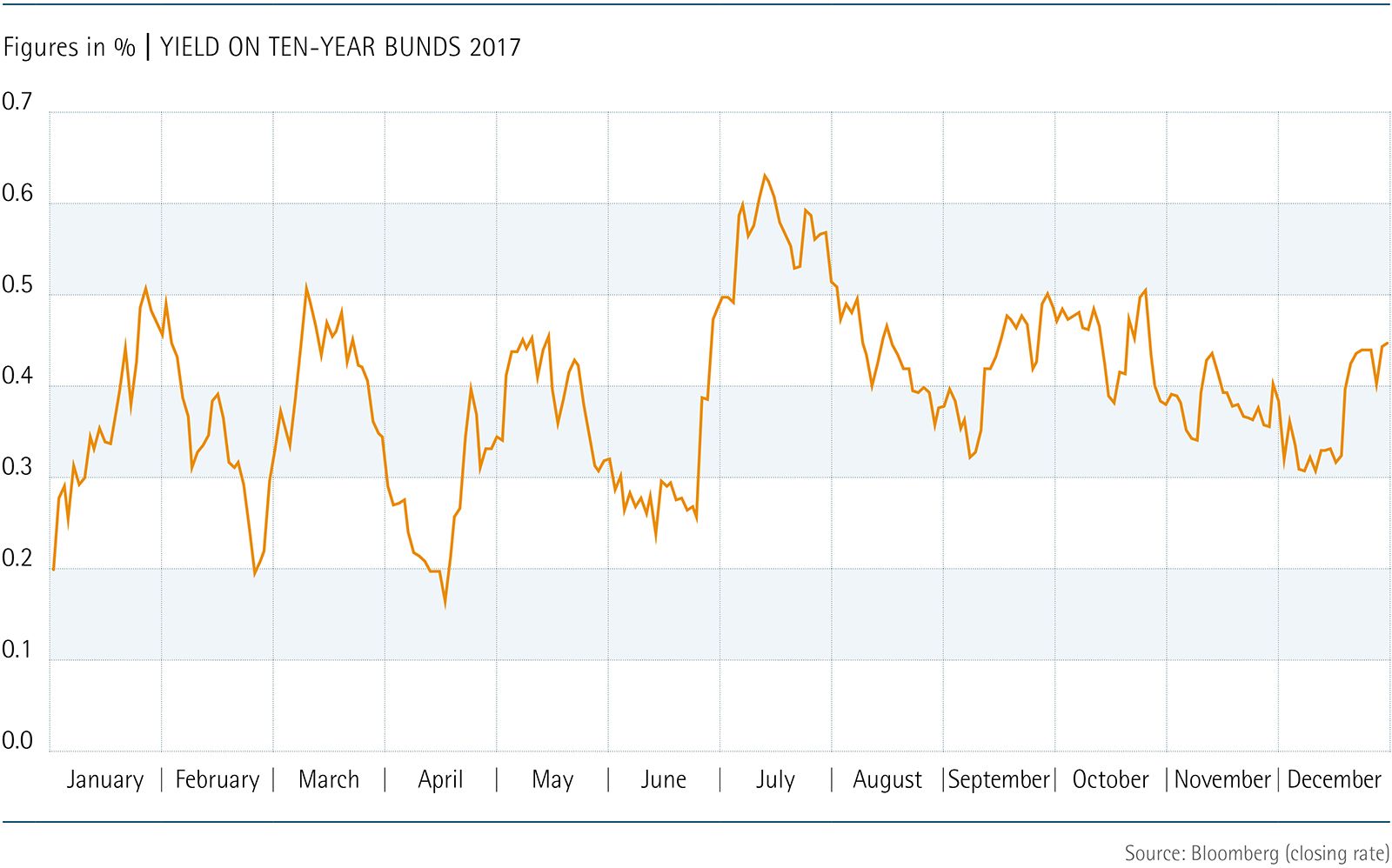

The ECB’s policy led to further declines in spreads versus swaps and a slight increase in yields in the bond market. Over the course of the year the yield on 10-year Bunds rose moderately from 0.20 percent to 0.42 percent and was primarily driven by adjusted expectations in light of the economic upswing in the euro area. Yields on longer term treasury bonds in the USA still remained stable despite increased interest rates. Shorter maturities moved in line with interest rates increases resulting in a notable flattening of the yield curve. Starting at the mid-year point capital markets increasingly believed that the ECB was really aiming to achieve normal conditions and not a further loosening of its monetary policy. In contrast, the ECB’s continued purchases of sovereign bonds, covered bonds, corporate bonds and asset-backed securities supported these asset classes and in some instances resulted in a further tightening of spreads.

In the currency markets the US dollar tended to weaken over the year despite the substantial increase in US money market interest rates and unbroken low euro rates. This development was in response to declining political risks and the surprisingly favourable development of the European economy. Over the course of 2017 the US dollar lost 14 cents to the euro and at the end of the year stood at 1.19 to the euro. The euro also posted significant gains over the Swiss franc during the year adding 9 percent to about 1.17 CHF. Although the British pound had already lost substantial value due to the Brexit decision it continued to weaken into 2017, albeit at a slightly slower pace. The improved outlook for an orderly Brexit had a stabilising effect on the pound in the second half of the year. Over the course of the year the pound fell by about 4 percent to end the year at 0.89 euro.

The covered bond market remained heavily influenced by the ECB’s Covered Bond Purchase Programme (CBPP 3). About 30 percent of the volume of new issues was bought by the ECB. Although classical investors like banks, insurance companies and funds were active as buyers, the low level of interest rates and spreads limited their willingness to build new positions. Nevertheless, investments in covered bonds continued to benefit from their high credit standing and preferential regulatory treatment. The volume of new euro-denominated benchmark covered bond issues did, however, decline from € 127 billion in 2016 to € 112 billion in 2017, with a notable weakening seen in the second half of the year. French covered bonds represented 25.7 of the total volume of new covered bond issues in 2017 giving them the largest market share followed by German Pfandbriefe with 18.7 percent.