Balance Sheet Structure

By the end of 2017 total assets had risen to € 38.9 billion, following € 38.5 billion at 31 December 2016. The increase was driven by the unbroken favourable development of our new business results.

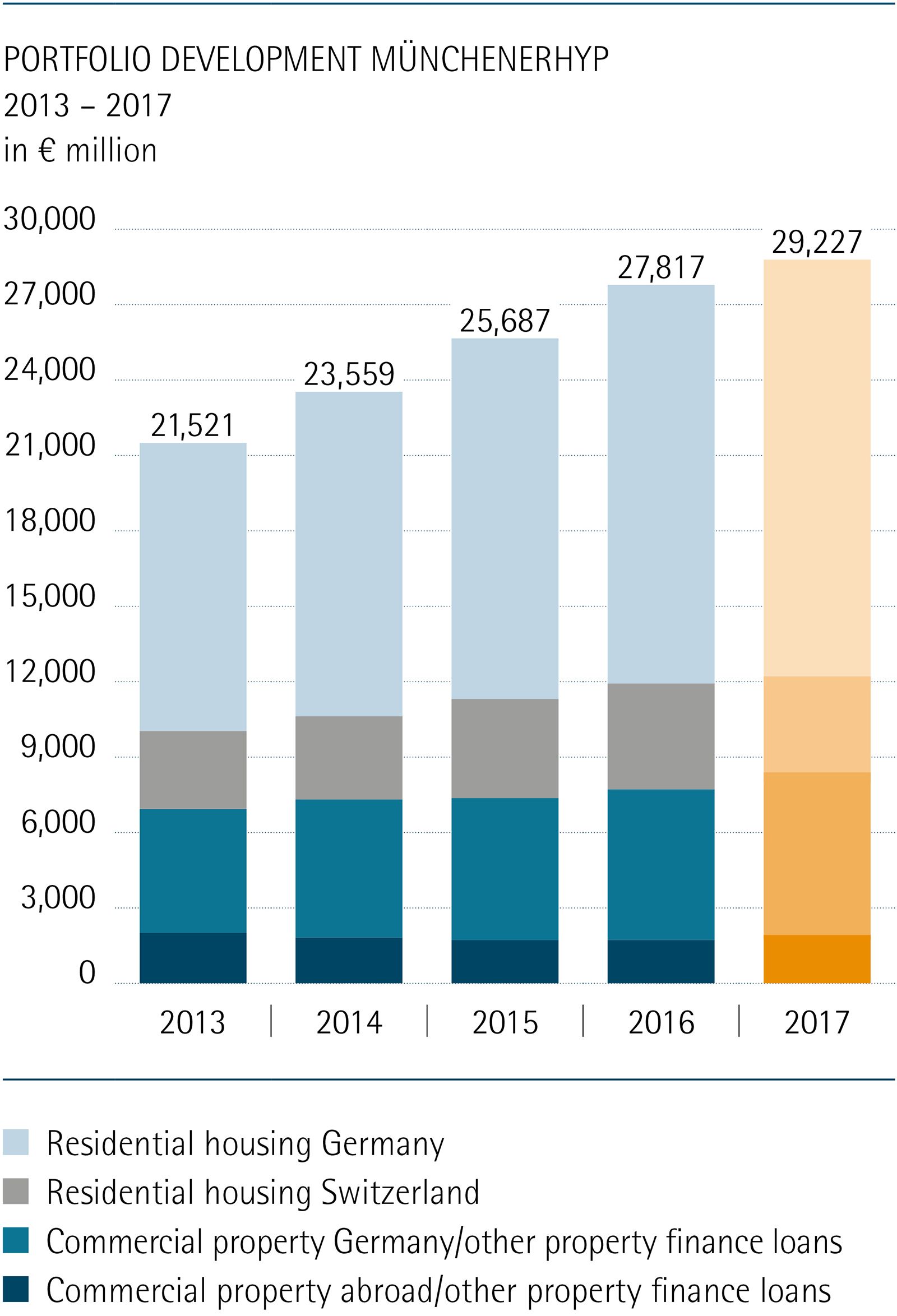

Our portfolio of mortgage loans grew by € 1.4 billion over the course of the year to € 29.2 billion. Private residential property financing was again the strongest growing segment of our business as it increased by € 1.0 billion.

Our portfolio of private residential property loans is structured as follows: domestic mortgage loans € 17.0 billion (previous year € 15.9 billion), foreign mortgage loans € 4.1 billion (previous year € 4.2 billion), which are solely loans made to finance residential property in Switzerland.

Our portfolio of commercial property loans totalled to € 8.1 billion (previous year € 7.7 billion), of which € 1.9 billion (previous year € 1.7 billion) represented loans made outside of Germany. Great Britain is our most important foreign market with 25 percent (previous year 23 percent), followed by the Netherlands with 21 percent (previous year 20 percent) and France with 18 percent (previous year 18 percent). Property we financed in the USA accounted for 10 percent (previous year 13 percent) of the total.

In accordance with our business and risk strategy, our portfolio of loans and securities related to our business with the publicsector and banks declined further from € 6.8 billion to € 5.7 billion, of which € 2.4 billion were securities and bonds.

At the end of 2017 the net sum of unrealised losses and unrealised gains in our securities portfolio amounted to plus € 58 million (previous year plus € 41 million). These figures include unrealised losses of € 1 million (previous year € 6 million) stemming from securities issued by countries located on the periphery of the euro area and banks domiciled in these countries. The total volume of these securities still amounted to € 0.4 billion (previous year € 0.6 billion).

Following a detailed examination of all securities we came to the conclusion that no permanent reductions in value are required. We are keeping these bonds on our books with the intention of holding them until they mature. Write-downs to a lower fair value were not necessary.

The portfolio of long-term refinancing funds increased by € 1.3 billion to € 34.1 billion, of which € 23.1 billion consisted of Mortgage Pfandbriefe, € 3.4 billion of Public Pfandbriefe and € 7.6 billion of unsecured bonds. The total volume of refinancing funds – including money market funds – increased from € 35.8 billion in the previous year to € 36.4 billion on 31 December 2017.

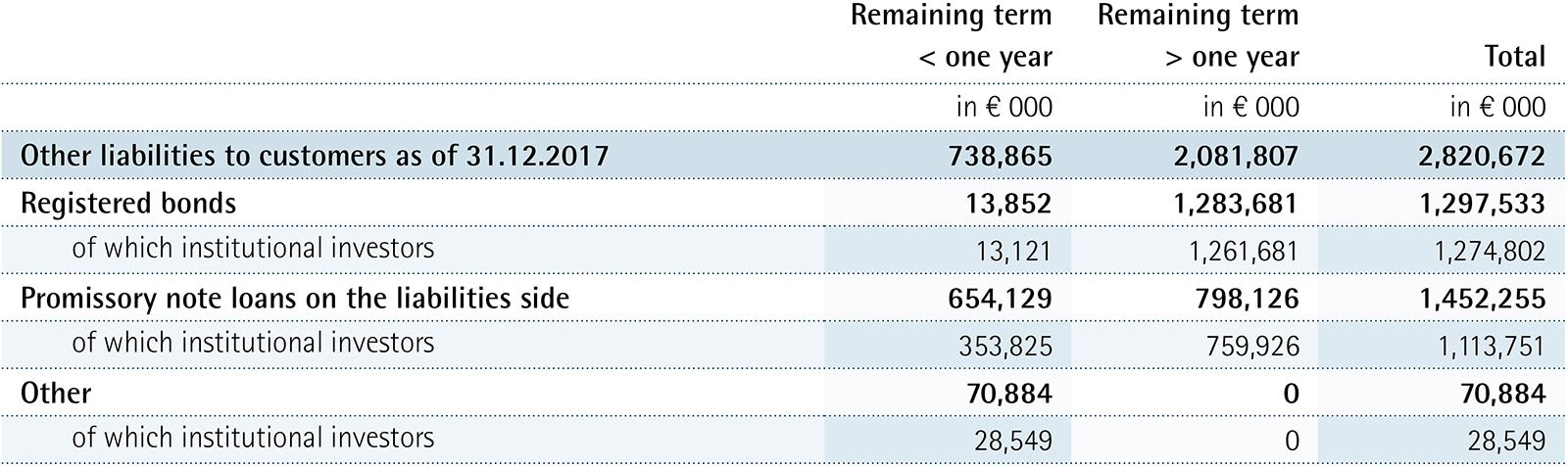

The item “Other liabilities to customers” is structured as follows:

Paid-up capital increased by € 49.0 million to € 1,004.9 million. Total regulatory equity capital amounted to € 1,390.9 million (previous year: € 1,343.1 million).

Common Equity Tier 1 capital rose from € 1,251.3 million in the previous year to € 1,316.0 million. On 31 December 2017 the Common Equity Tier 1 capital ratio was 23.8 percent (previous year 22.9 percent), the Tier 1 capital ratio was also 23.8 percent (previous year 22.9 percent) while the total capital ratio was 25.2 percent (previous year 24.5 percent). The leverage ratio was 3.4 percent on 31 December 2017.